new mortage rules for may 1st

Moderators: carlson1, Charles L. Cotton

-

powerboatr

Topic author - Senior Member

- Posts in topic: 3

- Posts: 2273

- Joined: Mon Mar 23, 2009 9:53 pm

- Location: North East Texas

new mortage rules for may 1st

https://nypost.com/2023/04/16/how-the-u ... od-credit/

Talk about instant blood boil

so now people with GOOD and great credit get skewered to help pay for those persons with bad credit

OMG what is wrong with our country?

loan level price adjustments. if you have credit score above 680 to 7800 get a spike in costs and if you put money down 15% or more you get another fee

but if your credit is bad you get a discount rate on mortgage rates???????????

and people wonder why we the people are fed up with out of control government

Talk about instant blood boil

so now people with GOOD and great credit get skewered to help pay for those persons with bad credit

OMG what is wrong with our country?

loan level price adjustments. if you have credit score above 680 to 7800 get a spike in costs and if you put money down 15% or more you get another fee

but if your credit is bad you get a discount rate on mortgage rates???????????

and people wonder why we the people are fed up with out of control government

Proud to have served for over 22 Years in the U.S. Navy Certificated FAA A&P technician since 1996

-

03Lightningrocks

- Senior Member

- Posts in topic: 2

- Posts: 11451

- Joined: Tue Apr 08, 2008 5:15 pm

- Location: Plano

Re: new mortage rules for may 1st

This will definitely lead to another mortgage induced collapse. When these people can't or won't pay their mortgages, the house of cards will once again come tumbling down.powerboatr wrote: ↑Thu Apr 20, 2023 9:03 am https://nypost.com/2023/04/16/how-the-u ... od-credit/

Talk about instant blood boil

so now people with GOOD and great credit get skewered to help pay for those persons with bad credit

OMG what is wrong with our country?

loan level price adjustments. if you have credit score above 680 to 7800 get a spike in costs and if you put money down 15% or more you get another fee

but if your credit is bad you get a discount rate on mortgage rates???????????

and people wonder why we the people are fed up with out of control government

NRA-Endowment Member

http://www.planoair.com

http://www.planoairconditioningandheating.com

http://www.planoair.com

http://www.planoairconditioningandheating.com

Re: new mortage rules for may 1st

Sounds like a great plan to collapse the economy.

JOIN NRA TODAY!, NRA Benefactor Life, TSRA Defender Life, Gun Owners of America Life, SAF, FPC, VCDL Member

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

LTC/SSC Instructor, NRA Certified Instructor, CRSO

The last hope of human liberty in this world rests on us. -Thomas Jefferson

-

OneGun

- Senior Member

- Posts in topic: 1

- Posts: 1147

- Joined: Sat Jun 07, 2014 11:22 am

- Location: Houston

Re: new mortage rules for may 1st

These policies are all about wealth transfer. I don't work to support people outside of my family. Maybe these people with bad credit need to fix their own problems.

Annoy a Liberal, GET A JOB!

-

Mel

- Senior Member

- Posts in topic: 1

- Posts: 593

- Joined: Fri Jun 11, 2010 5:47 pm

- Location: Farmersville, TX

Re: new mortage rules for may 1st

What's that famous quote I keep hearing on TV? "Do you owe over $10,000 on your credit card? It's not your fault!"

Mel

Airworthiness Inspector specializing in Experimental and Light-Sport Aircraft since the last Century.

Airworthiness Inspector specializing in Experimental and Light-Sport Aircraft since the last Century.

-

powerboatr

Topic author - Senior Member

- Posts in topic: 3

- Posts: 2273

- Joined: Mon Mar 23, 2009 9:53 pm

- Location: North East Texas

Re: new mortage rules for may 1st

seems washington forgot 2008 house collapse..it hit us hard out here in lake fork area

we had people no way qualified financially or JOBS wise that could afford houses or taxes..

we had over 30 homes sitting for years ..empty and not taken care of

then covid and these homes sold for 3x what they were worth and BOOM guess what ?? banks holding note made tons of money.

same thing is happening again. now these over priced homes and not low interest rates and TAXES are causing a record number of realtor signs

then i saw the news this morning...omg then the bit about if you credit is low...you get lower interest rates and those with great credit get higher rates??? HOW can that even be legal? isnt that discrimination ?

we had people no way qualified financially or JOBS wise that could afford houses or taxes..

we had over 30 homes sitting for years ..empty and not taken care of

then covid and these homes sold for 3x what they were worth and BOOM guess what ?? banks holding note made tons of money.

same thing is happening again. now these over priced homes and not low interest rates and TAXES are causing a record number of realtor signs

then i saw the news this morning...omg then the bit about if you credit is low...you get lower interest rates and those with great credit get higher rates??? HOW can that even be legal? isnt that discrimination ?

Proud to have served for over 22 Years in the U.S. Navy Certificated FAA A&P technician since 1996

-

LDB415

- Senior Member

- Posts in topic: 1

- Posts: 1662

- Joined: Sat Jun 21, 2014 12:01 am

- Location: Houston south suburb

Re: new mortage rules for may 1st

We need a good purging in all the houses, following proper grammatical procedures and working left to right.

It's fine if you disagree. I can't force you to be correct.

NRA Life Member, TSRA Life Member, GSSF Member

A pistol without a round chambered is an expensive paper weight.

NRA Life Member, TSRA Life Member, GSSF Member

A pistol without a round chambered is an expensive paper weight.

Re: new mortage rules for may 1st

So this is real?

How quickly the world I grew up in and remember has so quickly changed.

Up is down, down is up. Right is punished, wrong is rewarded.

How quickly the world I grew up in and remember has so quickly changed.

Up is down, down is up. Right is punished, wrong is rewarded.

-

powerboatr

Topic author - Senior Member

- Posts in topic: 3

- Posts: 2273

- Joined: Mon Mar 23, 2009 9:53 pm

- Location: North East Texas

Re: new mortage rules for may 1st

yup crazy as you know what

i did some math on the 300k home if you have good credit the 40 extra a month over 20 year mortgage is just under 10k added fees

crazy crazy

more money down also nets you a fee for having to much money

and i bet home Byers paying cash, are about to get hit with a 3% fee just watch on top of everything else

Proud to have served for over 22 Years in the U.S. Navy Certificated FAA A&P technician since 1996

Re: new mortage rules for may 1st

powerboatr wrote: ↑Mon Apr 24, 2023 4:29 pmThe state of our affairs is such that I cannot disagree with that prognostication. If it 3%, I still bet it'll something. One way Brandon's administration is proposing going after the wealthy--by taxing unrealized gains (e.g., the stock for a company goes up; you own a lot of that stock; you should be taxed as income the increased value even if you don't sell a single share of it)--would kinda shoehorn right into taxing unrealized gains on property. You paid $300K cash for your home in 2020 and its property tax appraisal is now $420K? Well, then, Mr. Rich Guy, you should be paying income tax on that $120K you "earned."

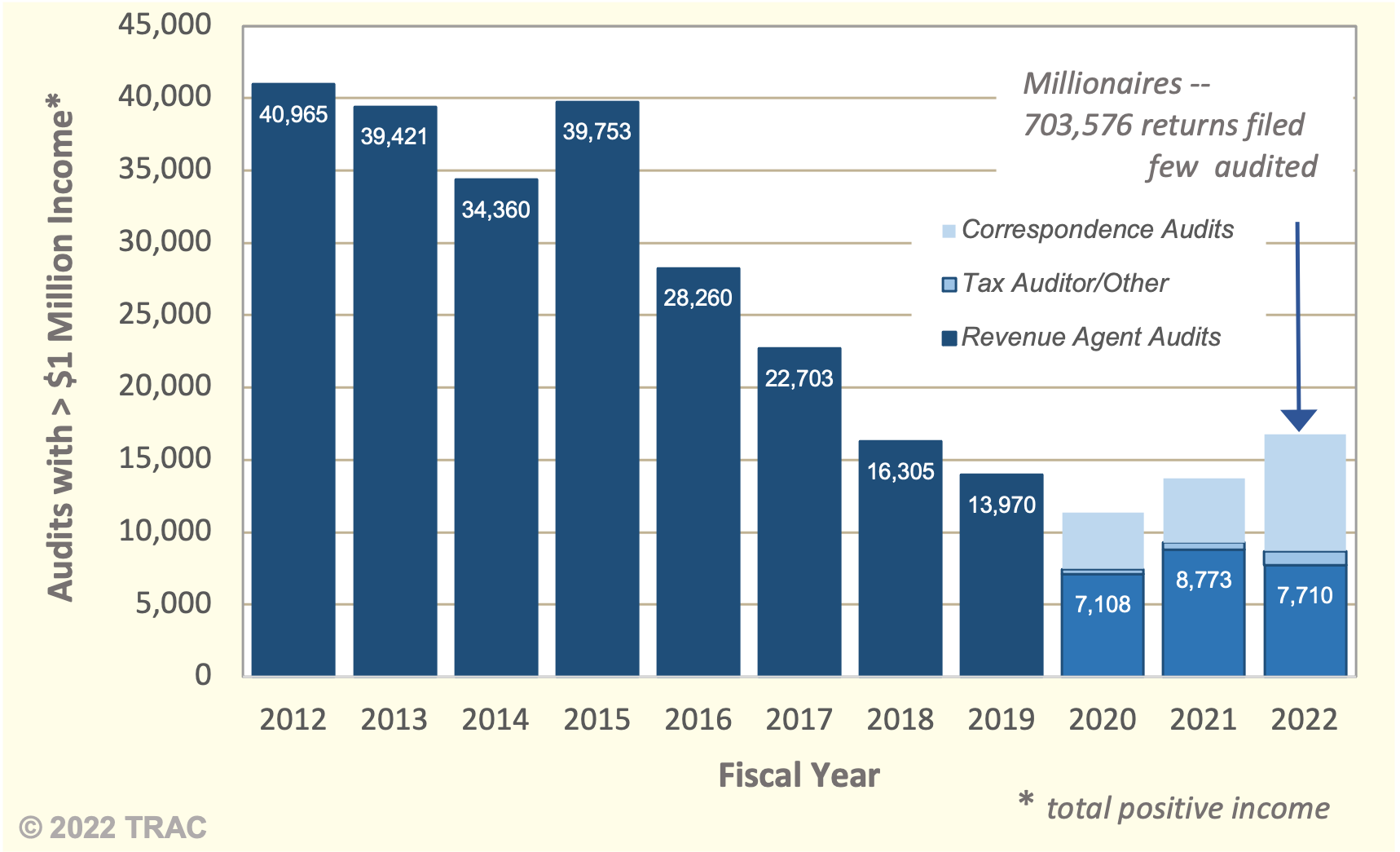

And what about those 80,000+ new IRS agents and the massive new IRS budget? Brandon: Nobody making less than $400K will see any new taxes. The new IRS beef-up is all about better customer service and going after those evil wealthy people who our Dimocrat base feels are harming the poor by making so much money.

Uh huh. A study of 2022 IRS tax audit data found that a taxpayer in the lowest income bracket is five times more likely to face an audit that would a member of the highest income bracket. See https://www.foxnews.com/politics/irs-ta ... 022-report.

"The IRS correspondence audit process is structured to expend the least amount of resources to conduct the largest number of examinations – resulting in the lowest level of customer service to taxpayers having the greatest need for assistance," National Taxpayer Advocate Erin M. Collins said of the report during an annual report to Congress.

The Transactional Records Access Clearinghouse (TRAC) at Syracuse University examines internal IRS management reports each month, and the group noticed different trends by reviewing 2022 data. Most notably, the group looked at audits, particularly considering the agency relying more heavily on automatically produced letters sent to taxpayers.

The data showed that the IRS conducted 85% of its audits through these letters, which request additional information and documentation related to specific items of interest....

The rate of income tax audits for those in the lowest income bracket hit 12.7 per 1,000, compared to 2.3 per 1,000 among those in the highest – a nearly five-fold increase. The odds of a millionaire facing an audit were around 1.1%.

(I have no idea why that image is showing as a tiny thumbnail; I've made it a link so you should be able to click on it to see the chart full-size.)

Remember that line, "The IRS correspondence audit process is structured to expend the least amount of resources to conduct the largest number of examinations"? A corollary to that is: Poorer people can't afford high-powered tax lawyers. It's a huge hassle and cost to the IRS to go after the very wealthy, and the very wealthy have a fleet of attorneys that would rather take the person's money than have the IRS get it.

You and me Average Joe? How much do we have to spend on tax attorneys? Add to that the fact that very little of that massive bump in the IRS's budget is actually going toward customer support. People report that they can reach a live agent--even when it isn't tax season--in only 1 in 5 attempts. And I don't expect that to change. The bulk of the HR budget increase is going to be in revenue agents.

On a per-case basis, it's far more cost-effective and efficient to go after the majority of the population that has a family income of around $250K or less. The IRS may not get a whole lot per case compared to going after the wealthiest, but it also doesn't drag out for years while attorneys battle it out. And COVID introduced a lot of people to "side gigging," freelancing for income to fill the gap when they were unemployed...and the employment participation rate would imply that a lot of them continue to do that, some as their exclusive source of income. Keeping track of a freelance sole proprietorship like that makes for rich IRS audit fields.

Despite what the Dimocrats say, the middle class and the lower-middle are getting hammered by inflation (in aggregate, the Brandon inflation years are adding up to around a 15% cumulative increase in many consumer goods and, if history tells us anything, those increases won't come down appreciably even if the inflation rate does); he's still fighting to whitewash student loans, at taxpayer expense; the undocumented are flooding across the border at unprecedented rates and costing taxpayers on both the front (enforcement and processing) and back (transportation, welfare, medical care) ends; so why not continue to penalize the hard-working people who pay their bills and always try to file honest tax returns? After all, a lot of them are those are religious, conservative types who vote Republican anyway.

“Be ready; now is the beginning of happenings.”

― Robert E. Howard, Swords of Shahrazar

― Robert E. Howard, Swords of Shahrazar

-

03Lightningrocks

- Senior Member

- Posts in topic: 2

- Posts: 11451

- Joined: Tue Apr 08, 2008 5:15 pm

- Location: Plano

Re: new mortage rules for may 1st

Rafe wrote: ↑Tue Apr 25, 2023 12:19 pmpowerboatr wrote: ↑Mon Apr 24, 2023 4:29 pmThe state of our affairs is such that I cannot disagree with that prognostication. If it 3%, I still bet it'll something. One way Brandon's administration is proposing going after the wealthy--by taxing unrealized gains (e.g., the stock for a company goes up; you own a lot of that stock; you should be taxed as income the increased value even if you don't sell a single share of it)--would kinda shoehorn right into taxing unrealized gains on property. You paid $300K cash for your home in 2020 and its property tax appraisal is now $420K? Well, then, Mr. Rich Guy, you should be paying income tax on that $120K you "earned."

And what about those 80,000+ new IRS agents and the massive new IRS budget? Brandon: Nobody making less than $400K will see any new taxes. The new IRS beef-up is all about better customer service and going after those evil wealthy people who our Dimocrat base feels are harming the poor by making so much money.

Uh huh. A study of 2022 IRS tax audit data found that a taxpayer in the lowest income bracket is five times more likely to face an audit that would a member of the highest income bracket. See https://www.foxnews.com/politics/irs-ta ... 022-report.

"The IRS correspondence audit process is structured to expend the least amount of resources to conduct the largest number of examinations – resulting in the lowest level of customer service to taxpayers having the greatest need for assistance," National Taxpayer Advocate Erin M. Collins said of the report during an annual report to Congress.

The Transactional Records Access Clearinghouse (TRAC) at Syracuse University examines internal IRS management reports each month, and the group noticed different trends by reviewing 2022 data. Most notably, the group looked at audits, particularly considering the agency relying more heavily on automatically produced letters sent to taxpayers.

The data showed that the IRS conducted 85% of its audits through these letters, which request additional information and documentation related to specific items of interest....

The rate of income tax audits for those in the lowest income bracket hit 12.7 per 1,000, compared to 2.3 per 1,000 among those in the highest – a nearly five-fold increase. The odds of a millionaire facing an audit were around 1.1%.

(I have no idea why that image is showing as a tiny thumbnail; I've made it a link so you should be able to click on it to see the chart full-size.)

Remember that line, "The IRS correspondence audit process is structured to expend the least amount of resources to conduct the largest number of examinations"? A corollary to that is: Poorer people can't afford high-powered tax lawyers. It's a huge hassle and cost to the IRS to go after the very wealthy, and the very wealthy have a fleet of attorneys that would rather take the person's money than have the IRS get it.

You and me Average Joe? How much do we have to spend on tax attorneys? Add to that the fact that very little of that massive bump in the IRS's budget is actually going toward customer support. People report that they can reach a live agent--even when it isn't tax season--in only 1 in 5 attempts. And I don't expect that to change. The bulk of the HR budget increase is going to be in revenue agents.

On a per-case basis, it's far more cost-effective and efficient to go after the majority of the population that has a family income of around $250K or less. The IRS may not get a whole lot per case compared to going after the wealthiest, but it also doesn't drag out for years while attorneys battle it out. And COVID introduced a lot of people to "side gigging," freelancing for income to fill the gap when they were unemployed...and the employment participation rate would imply that a lot of them continue to do that, some as their exclusive source of income. Keeping track of a freelance sole proprietorship like that makes for rich IRS audit fields.

Despite what the Dimocrats say, the middle class and the lower-middle are getting hammered by inflation (in aggregate, the Brandon inflation years are adding up to around a 15% cumulative increase in many consumer goods and, if history tells us anything, those increases won't come down appreciably even if the inflation rate does); he's still fighting to whitewash student loans, at taxpayer expense; the undocumented are flooding across the border at unprecedented rates and costing taxpayers on both the front (enforcement and processing) and back (transportation, welfare, medical care) ends; so why not continue to penalize the hard-working people who pay their bills and always try to file honest tax returns? After all, a lot of them are those are religious, conservative types who vote Republican anyway.

Democrats will not be happy until they have destroyed the entire middle class.

NRA-Endowment Member

http://www.planoair.com

http://www.planoairconditioningandheating.com

http://www.planoair.com

http://www.planoairconditioningandheating.com

-

The Annoyed Man

- Senior Member

- Posts in topic: 1

- Posts: 26799

- Joined: Wed Jan 16, 2008 12:59 pm

- Location: North Richland Hills, Texas

- Contact:

Re: new mortage rules for may 1st

My guess is that people with mortgages, who aren’t poor, are going to desert the DNC (AKA “commies”) in 2024.

“Hard times create strong men. Strong men create good times. Good times create weak men. And, weak men create hard times.”

― G. Michael Hopf, "Those Who Remain"

#TINVOWOOT

― G. Michael Hopf, "Those Who Remain"

#TINVOWOOT

-

anygunanywhere

- Senior Member

- Posts in topic: 1

- Posts: 7863

- Joined: Fri Apr 01, 2005 9:16 am

- Location: Richmond, Texas

Re: new mortage rules for may 1st

Nah. Never happen.The Annoyed Man wrote: ↑Tue Apr 25, 2023 6:06 pm My guess is that people with mortgages, who aren’t poor, are going to desert the DNC (AKA “commies”) in 2024.

"When democracy turns to tyranny, the armed citizen still gets to vote." Mike Vanderboegh

"The Smallest Minority on earth is the individual. Those who deny individual rights cannot claim to be defenders of minorities." – Ayn Rand

"The Smallest Minority on earth is the individual. Those who deny individual rights cannot claim to be defenders of minorities." – Ayn Rand

Re: new mortage rules for may 1st

That’s been Brandon’s economic policy since day one. The worse the economy (and everything else) the more the federal government “needs” to create and exercise new powers. Health care, mass shootings, high inflation, supply chain shortages, spikes in crime, loss of faith and rationality in the justice system, indoctrinating the military to left wing values; it serves to destabilize the current form of government and society. In other words, it’s setting the stage for a revolution.

ETA: But Trump! (I.e. claim your opponent is guilty of what you are actually doing.)

USAF 1982-2005

____________

____________