The federal income tax is designed to be progressive, meaning that those who make more money are supposed to pay taxes at higher rates. But the richest Americans don’t. Public data shows that in 2018, the most recent year for which data is available, the top 0.001 percent of taxpayers — roughly 1,400 households — paid a smaller share of income in taxes than the rest of the top 1 percent. The effective tax rate for that elite group was 22.9 percent.

This statement is proof that the NY Times knows how to lie very, very well. While they made only true statements, they did it in such a way as to make you believe something that has not yet been shown to be true.

Statement #1 was that we have a progressive income tax and the higher your income, the higher your tax rate. This is a true statement.

Statement #2 was that a small group of the very wealthy paid taxes at an effective rate of only 22.9%. While I do not have access to the data used to calculate this, I am going to give them the benefit of the doubt and assume it is true. But a key point left out of this is what they defined as income and how they calculated the tax to get "the effective rate", which is not a rate written in the law.

Statement #3 was that this was a smaller share of their income than the remainder of the top 1%. I do not have any way to know if this is true or not.

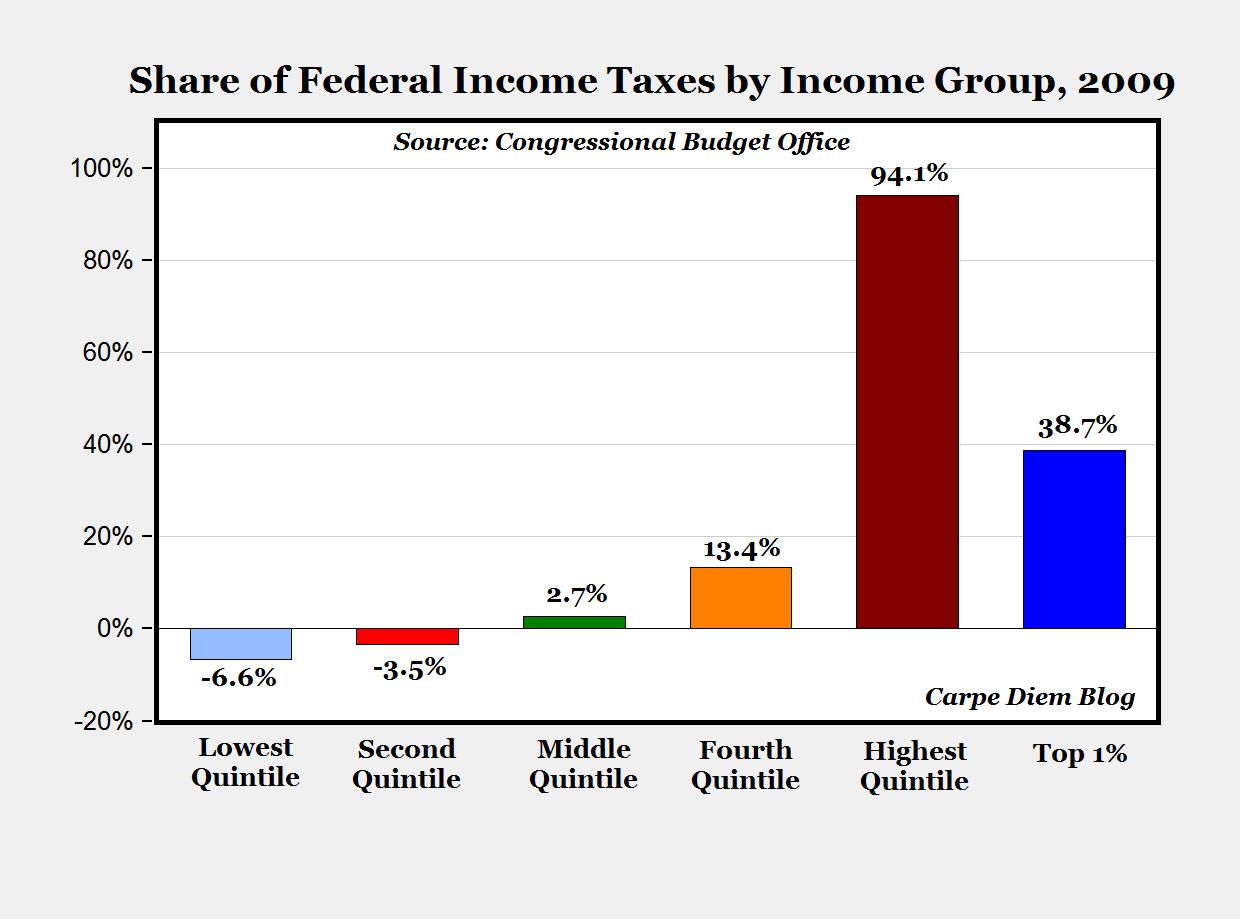

But the implication is that these people are paying much lower shares of their income than most Americans. That has not been shown by this data and is not something I believe to be a true statement. I have a daughter who made about $30,000 last year. She had 1,700 withheld in taxes. But as a single mother, her taxable income was 0 and she received a refund of over 7,500. Subtracting the 1,700 she paid in from the refund means she had an effective tax rate of about negative 16%. So she paid much less than those rich guys who paid in 20%. My wife and I make a salary that is above the median for Texas, right about the 80th percentile (top 20%). Our effective tax rate was about 6.5%, again much lower than those rich guys.

So, using anecdotal numbers since I do not have hard data to argue with, it appears to me that we have a progressive income tax that is working as intended. The top 1% paid a significantly higher percentage of their income than did those with lower incomes. I paid a significantly higher effective tax rate than did my daughter with much lower income than me.

That is not what NY Times would have you believe though. And they are lying (as in deliberately misleading people) to try to convince us of their point of view.

And despite having done this fact check, I still like my daughter's t-shirt that said she was an English major, you do the math.